Edward Baars chose this as it was a concept that slowly grew into the project by examples towards the capacity of the country teams to replicate and build upon, it also worked well in synergy with Monitoring Learning and Evaluation (MEL), whilst besides showing its capacity to reach output targets, it opened interest to research on its effectiveness and sustainability which in 2018 is a main activity for this learning grant project. First appeared in Podcaster 33, September and October 2015.

N2Africa proudly takes stock of the strategic partnerships established to scale out and sustain its promoted services and technologies. Being implemented in 11 countries, N2Africa sealed 86 comprehensive partnerships with public and private organizations reaching 222,850 farmers in 2015-16 and aiming towards 550,000 in 2018. The partnerships are linked to value chain projects with similar objectives, leveraging resources and creating synergies. In this article we describe how partners view the benefits of partnerships, the various market models used in partnerships and the main challenge different legume value-chain partners encounter: how to generate sufficient supply of produce for a market based approach. Using one specific example, we disentangle the factors that determine supply by farmer cooperatives.

|

Joined efforts All project countries formed strategic partnerships. As an example, partners summarized such a partnership for Ethiopia in a poster (on the next page). Ethiopia spearheaded the partnership formation, which was earlier elaborated on in the January-February 2015 Podcaster (29). The ‘Tanzanian Legume Alliance’ poster, showing a large partnership, recently featured in international events held in Berlin, Oxford and The Hague. During the recent partner planning meetings it became clear that many partners thought the same: ‘we cannot hope to achieve our common objectives on our own’. They also recognized that there are many challenges ahead to achieve the objectives. The consensus was that when efforts of various partners are joined and when partners can learn from each other, the chances that goals can be met are higher. Better coordination among partners was therefore high on the agenda when the partnership agreements were signed and put into action. In addition, structures and modes of operations to achieve common goals were agreed upon. |

Figure 1: Ethiopia PPP Poster |

The N2Africa coordination and planning efforts so far already received appreciation. Addis Teshome of IFDC mentioned that ‘with N2Africa to have taken up responsibilities for dissemination, IFDC can now focus better on the marketing aspects for their farmers’. Abubakari Kijoji of CRS Tanzania stressed ‘N2Africa made an important contribution to the capacity building to our Soya ni Pesa Project’.

Market models

The first pillar that was mentioned under discussion during annual partner planning meetings in Nigeria, Ghana, Uganda, Ethiopia and Tanzania was always ‘the Market’. Across the partnerships, various models for markets are used. One of the market models that is commonly used in N2Africa is a (variation on) the ‘out-grower’ model. In those cases a strong ‘buyer’ supports its contracted farmers with inputs, credit, training on post-harvest handling, quality control, thereby also focussing on information flows and building trust relations with the farmers. ACOS, seen in figure 1, is one of those cases. Other examples are GUTS Agro Industry Plc, Alema Koudijs Feed Plc (AKF) in Ethiopia; WACOT, Hule and Sons, De ldeal Agro Allied Services, Mernan Jef Concept, Emma & Co, Madakiya Women Processing Group, Falke oil and AACE Foods in Nigeria, AgDevCo and Premium Foods in Ghana, Export Trading Group (ETG) and Kilimo Markets Ltd. in Tanzania.

In other cases, N2Africa and partners build farmers’ business skills and organizational capacities to improve on their marketing. Skills and capacities include sourcing seed, using seed, using (bio-)fertilizer, good agricultural practices, post-harvest handling, storage and quality control. Meanwhile farmers stay informed of and are linked to market demand.

|

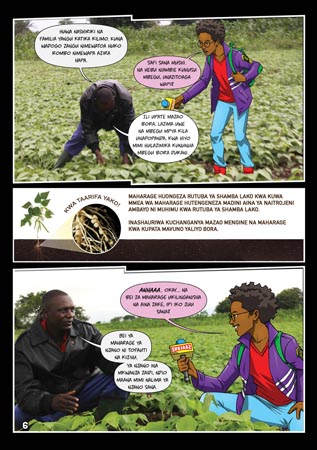

Legume Alliance We also saw cross fertilization between partnerships. A good example of this is the Legume Alliance, coordinated by the CABI-African Soil Health Consortium (ASHC-II). The Alliance is now implementing the campaign on Maharage Bingwa (Champion Beans) in which they develop and share information on common bean technologies with different partners. One of the strengths is that different partners use different media to disseminate information, ranging from radio to comics, thereby reaching different audiences. Figure 2 shows a page from a comic made by Maharage Bingwa partner Shujaaz, which uses mass circulation comics, YouTube and social media to target younger members of the farming families with inspirational ideas on new varieties and good agricultural practices. The article on page 6 of this Podcaster gives more information on the Maharage Bingwa campaign.

|

Figure 2: Comic page Shujaaz |

In terms of partnerships, the Legume Alliance includes CABI, Farm Radio International (FRI), African Fertilizer Agribusiness Partnership (AFAP), IITA and the Agricultural Seeds Agency (ASA) as partners. The Alliance also cross cuts the N2Africa partnerships with CRS, BRAC-ETG, Faida MaLi-ARI-Selian-Uyole and AGRA-RUDI- the African Conservation Tillage Network -BRiTEN. New projects to join the Alliance are the ICT Challenge Fund, Integrated Seed Systems Development (ISSD) and possibly the Integrated Value Chain Development (IVCD) Project.

Recently, the Legume Alliance was awarded the Canadian International Food Security Research Fund (CIFSRF) - Scale up of improved legume technologies through sustainable input supply and information systems!

The Challenge of supply

Kassahun Bekele of partner ACOS-Ethiopia mentioned, ‘we guarantee farmers a premium price for our registered variety of red kidney beans that serves a niche market but we don’t always get the quality and quantity we had hoped for’. This usually opens a lively discussion from all angles on how to jointly improve on this. Because the challenge of supply of raw material is a common denominator across partnerships and countries, we deliberate more on the possible causes in the case of ACOS.

The first question we can ask is whether the disappointing quantity of bean supply was caused by an unfavourable climate conditions or high pest and diseases pressure that particular season. But because several other cooperatives in the region reached near 100% delivery of their expectations, we cannot attribute the lack of supply only to these causes.

Could it then have been a lack of inputs? The cooperatives were funded in advance to pay farmers cash on delivery and farmers received credit for seeds and (bio)-fertilizers (to be deducted at harvest time). SNV – Agriterra facilitated a credit scheme for this which will be expanded in 2016. It thus seems that payment and credit facilities were in place. In addition, the cooperatives started their own seed multiplication in sufficient quantities using ACOS variety foundation seed. We therefore do not think that lack of seeds has been a problem. However, in some areas lentils compete with the ACOS variety, and the bean varieties used by ACOS seem to be slightly lower yielding than other bean varieties grown.

We can also ask whether some cooperatives might not be strong enough to produce sufficient quantity of sufficient quality. Some cooperatives are not ‘strong’ indeed. Currently, they are enrolled in an institutional capacity building program working to improve their performance.

The farmer perspective

The use of improved seeds, (bio) fertilizers and good agricultural practices were disseminated among farmers using demonstration and adaptation plots, Farmer Field Schools and training materials. The N2Africa Learning Monitoring & Evaluation (M&E) tools, including ‘technology evaluation’ and ‘willingness to buy’ surveys, are currently looking at the rate of adoption. In addition, they assess availability of inputs and monitor input demand and that can feedback to partnerships’ market models. The M&E can be rapidly expanded using Computer Aided Telephone Interviews (CATI).

Way forward

In conclusion, the way forward is to track the results of the joint activities and to start partner planning meetings with a ‘situation analysis’ from a farmer perspective using ICT based learning M&E surveys complemented by adoption studies from MSc. students. This is already planned for and ongoing in Mozambique, Nigeria, Ghana, Tanzania and Ethiopia.

Edward Baars