The Ghana Annual report 2018 presents last year’s results in compact way. There are developments ongoing in the soyabean sector that deserve to be highlighted.

Introduction

Soyabean was introduced into Ghana in 1901. However, it was not until the mid-1990s, that it became an important crop in Ghana. During the past decade, production has increased steadily from 74,800 Mt in 2008 to 176,670 Mt in 2018 while area under cultivation has increased from 61,800 ha to 102,980 ha during the same period (MoFA, 2019). Ghana’s soyabean sector is rapidly growing because of development of the poultry and freshwater fishery industries as well as exportation of soyabean to countries such as Turkey and China. Population growth, migration to urban centers and a growing middle-class have led to an increased demand for eggs, animal protein, and processed food and beverages. This, in turn, has increased demand for soyabean to supply food processing and poultry feed businesses.

According to the agricultural sector report, the soyabean annual production potential in Ghana is estimated at 700,000 Mt covering 250,000 ha (MoFA 2017). This provides the opportunity to improve food and nutritional security, improve smallholder farming incomes (improve the incomes of rural households), and enhance soil fertility and other environmental benefits.

Smallholder farmers with an average farm size of 1.4 ha are the main producers of soyabean. It is estimated that about 200,000 smallholder farmers are involved in soyabean production with an average of 0.5 ha under soyabean production per farmer per year. There are however few large producers of soyabean who through the nucleus farm system engage many smallholder producers as outgrowers and providing some level of support such as land preparation and seed supply.

Current soyabean supply and demand in Ghana

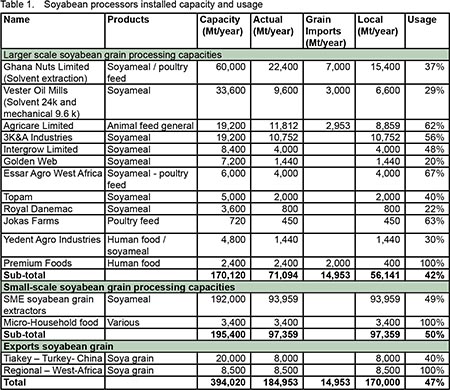

| There are 12 major soyabean grain processing companies in Ghana with capacity to process about 170,120 Mt per year. Two of the companies (Ghana Nuts with 60,000 Mt, and Vestor Oil 24,000 Mt) have solvent extractors, with combined annual solvent extraction capacity of 84,400 Mt (see Table 1). |  |

In addition, an estimated processing capacity of 192,000 Mt of soya by many small-scale or small-medium enterprise (SME) processors per year exists. At micro-enterprise and household level, soyabean grains are processed into various products for human consumption i.e. soyamilk, soya flour, soya kebab etc. with a small market share of about 3,400 Mt with grains sourced from own of community-based production.

A recent development (2018) in the sector is exports of non-GMO soyabean grains for niche markets in Turkey and China. Orders for 2019 were set at 20,000 Mt and expected to increase over time. In order to meet the ever-increasing demand for the Turkish market one of the companies has contracted a Nucleus farmer in Tamale to mobilize about 30,000 farmers to produce soyabean for the company over a five-year period beginning with 10,000 farmers in 2019. This company has signed an MoU with GreenEf company to supply him with 1.1 tons of inoculants this season. There are also cross-border regional buyers of soyabean grains from Ghana. These buyers are from Togo and Burkina Faso.

The current locally produced soyabean grain usage in Ghana is 170,000 Mt per year and equal to the current production level estimates by MoFA (2017). Besides this, nearly 15, 000 Mt of grains is imported by 4 of the major processing companies which accounts for about 9% of the total usage. Imports are mainly bought in times of local grain supply shortage ‘to keep customer going’. Local grain production usage accounts for about 33% of the total local processing capacity of the 12 major processing companies. Imported grains increases this to 42%.

Imports of soya and soya products

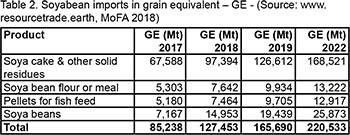

| To meet the country’s domestic feed requirements for the farmed fish and poultry (mainly layers-eggs) industries, Ghana imports large quantities of soya-based products annually (see Table 2). |  |

In 2017, imports were 85,238 Mt in grain equivalent (GE). Most imports are from Argentina and smaller quantities from the United States and Paraguay with minor quantities from over ten other countries. The MoFA, 2018 draft Agricultural sector report estimated that soya cake-meal imports in GE reached 112,500 Mt in 2018 and soyabean grain imports were 14,953, giving a total of 127, 453 Mt. If this trend continues, soyabean imports in grain equivalent will be about 165,690 Mt in 2019.

If local production does not significantly increase, it is further expected that due to increasing demand, imports will grow with at least 10% annually to 220,533 Mt per year in the next three years.

Current production challenges

In Ghana, soyabean is mainly grown by smallholder farmers with an average farm size of about 0.5 ha. Yields are however, highly variable and often poor. A recent (2018) N2Africa impact assessment survey, showed that the average smallholder farmer soyabean yields in the areas not intervened by N2Africa are less than 1,000 kg per ha confirming an earlier report by Zereyesus et al. (2013).

Potential yield of soyabean in Ghana is estimated at 2800 kg/ha (MoFA, 2009). N2Africa has proved that in the short term, farmers can increase their yields up to 2000 kg/ha using improved technologies (improved seeds, rhizobium inoculant and phosphorus fertilizer). The poor yields are due to these factors: use of low yielding varieties and limited use of inputs especially phosphorus (P) fertilizers, rhizobium inoculants and certified seeds.

The very low levels of mechanization in the production of soyabean from production to post-harvest processing makes small- and medium-scale soyabean production unattractive to the youth who make up the bulk of the population.

Production is scattered with large quantities of production done and marketed by individual farmers making it difficult for aggregators to mob up production from these individual farmers scattered over large areas. Most of these farmers do not have access to credit to purchase inputs such as certified seeds, fertilizers and inoculants.

N2Africa’s contribution to soyabean sector development

N2Africa has identified the best suited soyabean varieties which are non-shattering, drought and disease tolerant, and effective rhizobium inoculants for northern Ghana. Due to the lack of a suitable fertilizer blend for legumes, Yara has developed and tested a crop nutrition solution for soyabean. This ‘soyabean partnership solution’ has been subjected to widespread conditions in multiple seasons in farmers’ fields in northern Ghana and shown to be robust.

Coupled with good agronomy (timely sowing, optimal plant densities and weeding) yields of 2 t/ha are achieved. Strong scientific evidence shows that the additional benefits of adding rhizobium inoculant with P fertilizer covers the cost of P for the farmer (as inoculant is a relatively cheap input).

A public-private-partnership (PPP) facilitated by N2Africa has over the past 4 years aligned key partners to address input and output constraints. SARI has produced foundation seeds for seed companies and MOFA together with some local NGOs have provided extension support to farmers. Heritage Seed Company, Antika Agro-input company and other seed companies have supplied about 555 tons of certified soyabean seeds. Yara Ghana has supplied over 2,600 tons of Yara Legume and other legume fertilizers as required. The Green-ef company has distributed about 1,131 kg of high-quality rhizobium inoculants to meet demand. Savanna Farmers Marketing Company and other trading companies have ensured that farmers have access to a profitable soyabean market. This partnership reached out to about 96,845 farmers within four years with improved legume technologies.

Way forward

Innovative financing is needed to support critical sectors along the value chain. Access to input credit by farmers is critical for increasing productivity of soyabean. The capacity of aggregators must be built to offer technical as well as financial support to producers. Development of strong association will help reduce individual selling, which promotes the informal arrangement and side selling. Structured contractual arrangement will improve consistency of supply of raw materials and give actors along the chain opportunity to forecast and plan their production and processing schedules.

Mechanization of the entire production chain from planting through to the postharvest processing is critical for the growth of the sector. The private sector must invest in appropriate mechanizations along the entire value chain to reduce drudgery associated with production of the crop in order to attract the youth into production of the crop.

With support from the government, development partners and input and output market players through a PPP arrangement, Ghana can be self-sufficient in soyabean production with opportunity for exporting soyabean to niche markets in Europe and Asia. This will not only improve the income and nutritional security of rural households but also soil fertility and other environmental benefits.

Samuel Adjei-Nsiah, N2Africa Country Coordinator

References

MoFA (2017). Facts and Figures, Agriculture in Ghana, Ministry of Food and Agriculture, Accra.

MoFA (2018). Facts and Figures, Agriculture in Ghana, Ministry of Food and Agriculture, Accra.

MoFA (2019). Facts and Figures, Agriculture in Ghana, Ministry of Food and Agriculture, Accra.

Zereyesus, Y., K. Ross, V. Amanor-Boadu and T. Dalton. Baseline Feed the Future Indicators for Ghana, 2012, Manhattan, K.S: Kansas State University Press, 2013.