Paul Woomer prefered to place this new article, saying: “Recently we met about the weak promotion of NoduMax in Nigeria and the team there seemed confused about the importance and approaches of test marketing, and this could help.”

Test marketing of BNF technologies through Kenya’s One Stop Shop network continues. In this report we examine the purchasing preference of 179 customers at 14 shops in advance of the 2017 long rains growing season. Three BNF technology products: BIOFIX inoculant, Sympal fertilizer and Saga soyabean, were provided to shop operator in return for keeping a detailed log of customers and their purchases. Test marketing was conducted between 2 March and 26 April 2017, but different agrodealers conducted test marketing over different intervals, with some ending and others starting in late March. These logs were compiled and interpreted in terms of total sales by these shops and products, customer purchasing patterns and estimated impacts from use of the BNF technologies sold to farmers.

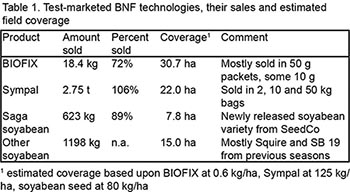

| The test-marketed customers were 45% women and 75% offered their mobile telephone numbers. Information on the test-marketed BNF products appears in Table 1. Sales ranged between 72% and 106% of products provided to agrodealers, with sales greater than 100% resulting from Sympal fertilizer ordered independently of the test-marketed supply. Stockists also marketed two other soyabean varieties distributed earlier for community-based seed production by the N2Africa project. This practice is risky because shops selling non-registered soyabean varieties are subject to penalties, but nonetheless nearly 1.2 tons of these seed were marketed as well (Table 1). |  |

|

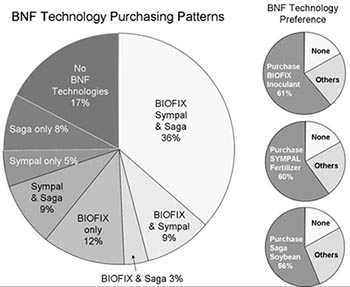

Figure 1. Purchases of 179 individual test-marketed customers |

Coding and sorting purchasing patterns allowed for eight customer types to be characterized (Figure 1). Our baseline recommendation is that soyabean producers purchase certified seed, BIOFIX inoculant and Sympal fertilizer, and 36% of customers did so. An additional 47% of these customers purchased one or two BNF technologies, suggesting that alternative seed systems and fertilizer strategies are in place, considering that no alternative soyabean inoculant appears in the market. Only 17% of the customers purchased farm inputs that were not among those offered by the test marketing campaign, mostly nitrogen-bearing fertilizers for maize and vegetables. Furthermore all three BNF technologies are acceptable to a majority of customers, with BIOFIX, Sympal and Saga purchased by 61%, 60% and 56% of customers, respectively (Figure 1). |

These findings bode well for full commercialization of BNF technologies to small-scale farmers in west Kenya, and is tempered by three factors. First, the One Stop Shops were intentionally located where N2Africa Project worked closely with farmer groups during its earlier activities, creating awareness and demand. Second, these shops were often located away from towns and other agrodealers, and offered a limited range of non-BNF technology products. Finally, the operators of these shops were offered training in marketing and use of BNF technologies, and provided with extension materials and product information. One factor that was not considered is the number of potential customers that visited the shop, but made no purchases.

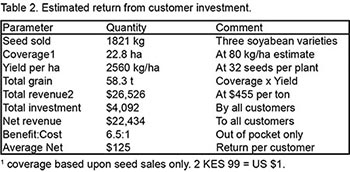

| The impact of BNF technologies distributed through test marketing may also be estimated based upon soyabean seed and assumptions concerning planting density and grain-to-seed increase (Table 2). These inputs cost about $4,100 and likely resulted in about 58 t of soyabean grain worth nearly $27,000. This resulted in a return ratio of 6.5:1 calculated in terms of out of pocket cost only (e.g. excluding unknown labor and opportunity costs). Ironically, this study itself cost about $35,000 to plan, conduct and analyze so in some ways it may be viewed as not cost effective. Mechanisms are being considered that can streamline test marketing costs in the future, including greater reliance upon electronic submission of data. In any event, every customer of these BNF technologies is estimated to have profited by an average $125 from their soyabean enterprise (Table 2). |  |

This marketing study signals the successful transition from earlier grassroots BNF technology promotion to commercialized BNF technology provision; a risky move that was deemed necessary to meet established milestones and exit strategy during the final year of Kenya’s N2Africa Project. Of the 15 agrodealers participating in the test-marketing campaign, reports were received from 14 (93%). The campaign itself was somewhat rushed because its planned February start was slightly delayed by project funding cycles. One consequence of hurried implementation is that this prevented us from better coordinating the size of product packages from different suppliers to specific N2Africa management recommendations. For example two kg of seed is intended for planting 250 m2 of land, but 50 g of BIOFIX inoculates five kg of seed, while 10 kg of Sympal fertilizes areas between 500 m2 and 800 m2. Out of necessity, we left this for shop operators and individual customers to sort out. Next season (2017-2018 short rains) product sizes shall be better matched with two kg of soyabean seed, 20 g BIOFIX and five kg Sympal all intended for establishing 250 m2 plots of soyabeans, and customers can scale up to their respective field areas in a more simplified manner. Finally, and despite this year’s planned end of the N2Africa Project in Kenya, we expect this market-oriented approach to technology promotion will continue in Kenya and expand to additional countries through the Technologies for African Agricultural Transformation Project (TAAT) likely to start later this year.

Acknowledgement: We greatly appreciate the participation of the following agrodealers in the test marketing of BNF technologies in west Kenya: AFDP Agrovet, Annapolis Wonder Enterprise, Farmer’s Key, Green Belt Shop, Kipeo Agrovet, Komame Agrodealer, KUFGRO Agro-enterprises, MFAGRO Agrodealer Shop, Power Mark, Trendy Forbes Agrodealer, Ugunja Community AgroVet and Ungeint OSS. MEA Fertilizers Ltd. and AgriSeed (Kenya) provided and delivered pre-packaged inputs for use in this study, and offered a modest sales discount as well.

Paul L. Woomer, Josephine Ongoma and Welissa Mulei (email: plwoomer@gmail.com)