A lot happened in N2Africa in 2017. As the core countries continued dissemination of technologies and strengthening of public-private partnerships to ensure sustainable access to these technologies, the Tier 1 countries focused on exit strategies to sustain the achieved results as N2Africa ended in these countries. The key achievements, lessons learned and focus in 2018 are summarized in the N2Africa Annual Report 2017 (http://www.n2africa.org/n2africa-annual-report-2017). Some of the main findings are presented below.

Key Achievements

Public-Private Partnerships: In 2017, 68 implementation partnerships were formally signed and 93% of the 2016 partnerships were consolidated. In addition, stakeholder platforms were used to address areas such as coordination and policy issues within legume value chains. The partnerships provide various models to gain access to input and output markets. The preferred and most widely used models were the “producer collective” model (44% of the partnerships), and the “buyer-driven” models (18%).

|

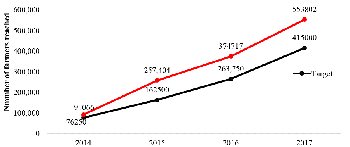

Awareness of Proven Technologies: In 2017, a total of 179,085 farmers were reached1 (47% female) through various dissemination approaches, resulting in a cumulative total of 553,802 farmers. This number exceeded the target by 33% (Figure 1). Key dissemination approaches were the organization of demonstrations, adaptations, field days, media events, and video shows. The effectiveness of these approaches has been assessed in Tanzania and Ghana, and results indicated for instance that although radio programmes reached more farmers in a cost-effective way, demonstration plots had a stronger influence on the depth of knowledge of farmers and their intention to adopt the promoted practices. Also, a mix of different approaches was found to be important to reach different audiences. (1 Reach means awareness and knowledge gained through dissemination approaches such as demonstrations, adaptations, field days, radio, video shows, SMS, etc.) |

|

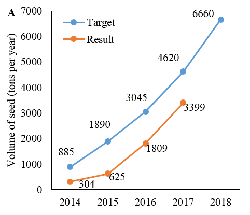

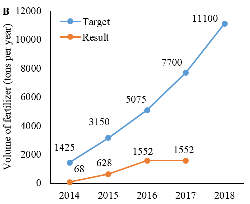

Access to Inputs: Although target volumes of sold inputs were only partly achieved (74% for seeds, 20% for fertilizers, 39% for inoculant; Figures 2A, B and C), strategies implemented in 2017 will continue to yield results as the private sector continues to invest. For instance, seed companies are contracting trained seed producers as out-growers (Ghana, Tanzania, Uganda). In addition, 136 agro-dealers in all countries were engaged and linked to various farmer groups. In Ghana, dissemination activities with YARA resulted in an increase in P-fertilizer used by farmers (from 150 t in 2016 to 194.6 t in 2017).

|

|

|

| Figure 2. Target and results of the volume (tons year-1) of (A) seeds, (B) fertilizer and (C) inoculant sold by seed companies, agro-dealers, and community based seed producers. |

|

Output Markets: Stimulating access to profitable markets enhances investment in input usage by smallholder farmers. By the end of 2017, a total of 149,818 persons (46% female) were involved in collective marketing (mainly soyabean and common bean). Soyabean has mostly formal markets with signed agreements with companies such as Hule & Sons in Nigeria, Silverland, G2L in Tanzania and Savannah Company in Ghana. Value addition activities (e.g. processing of soyabean into various products or groundnut oil extraction) are considered critical to provide options for the food basket for the poor. About 13 farmer groups (1,692 members) have integrated processed products at a household level, whereas 120 women in 26 groups are doing legume processing at commercial level (SME). In total, 12,000 women were involved in legume processing. |

|

From Best-Bet to Best-Fit Technologies: In adaptation trials, mean yields significantly increased on N2Africa plots compared with the farmers’ own legume plots: from 300 to 800 kg ha-1. More than half of the farmers had a yield increase of > 50%. In Ghana, New Yara legume fertilizer was tested as a new blend against triple superphosphate (TSP) fertilizer and outperformed TSP in cowpea, groundnut, and soyabean. In Tanzania bush beans showed a good response to inoculants in demonstration trials and in Uganda liming is now recommended for climbing beans.

Standard Operating Procedures for Inoculant Quality Control: Standard Operating Procedures (SOPs) for quality control were prepared in collaboration with experts from the COMPRO project. SOPs cut across the entire distribution chain. Kwame Nkrumah University of Science and Technology (KNUST) in Ghana ensured independent quality control of LEGUMEFIX and NoduMax. In Nigeria, quality control of NoduMax is currently done by N2Africa but should be done by NAFDAC in future. In Uganda, quality control measures are currently being implemented. In Ethiopia, efforts are made to establish a quality control system in collaboration with the Ministry of Agriculture.

Learnings and Focus to Sustain Results

Ensuring Impact and Continuity through Partnerships: Many partners have embraced the technologies introduced through their partnership with N2Africa and have integrated these into their development programs (e.g. groundnut varieties introduced by N2Africa in Northern Ghana, CRS in Nigeria expanded activities into Sokoto State with their own funding and YARA Ghana Ltd blended the new legume fertilizer based on field results generated together with N2Africa). The focus for 2018 is to highlight gaps in the exit strategies for the core countries and to develop appropriate interventions together with partners.

Sustaining Private Sector Commitment for Input Delivery: The rigorous engagement with the private sector since 2016 has led to an improvement in access to inputs. Seed companies are key actors and specific interventions have been undertaken to resolve their challenges (e.g. capacity building in legume seed production, information on preferred varieties and market-demand quantification or access to foundation seeds of preferred varieties). Sustainable access to breeder and foundation seeds remains a bottleneck which will be addressed in 2018 through direct linkages between seed companies and institutions producing foundation seed (Ghana and Nigeria) or support to national systems (Tanzania). Similarly, farmer groups are making efforts to quantify their demands which is key to such inputs being stocked by agro-dealers in future. Partners in Tanzania have adopted the village-based agricultural advisory system for input demand quantification, and ICT systems are being piloted in Ethiopia, Ghana, Nigeria, and Uganda.

Linking Farmer Groups to Output Markets: Increased numbers of farmers have improved access to markets, either collectively or individually. The key challenge remains meeting market requirements (quality and quantity of grains produced), developing the right contracts with buyers (taking into account the needs of both buyers and farmers) and providing platforms for market information. Strategies for 2018 largely focus on building organizational capacity of farmer groups to meet market requirements.

Making Best-Fit Technologies Available for Continuous Dissemination: The use of farmers’ feedback in evaluation of technologies to reshape technology packages has resulted in the dissemination of the most preferred options. The focus for 2018 is to document sets of best-fit technologies and location-specific options to ensure their availability to partners for continuous dissemination.

Compiled by Esther Ronner, Wageningen University & Research